Tax Guidance

Nearly all financial decisions affect your taxes.

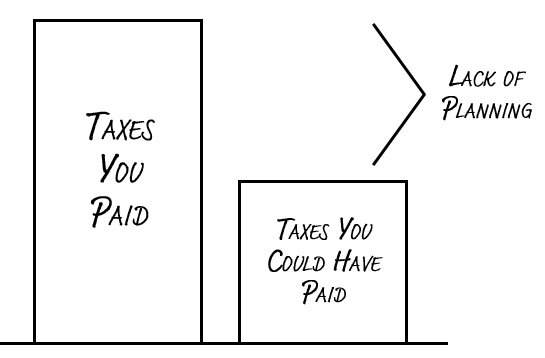

Many people focus on trying to minimize their taxes in the current year. Tax planning is strategically managing your finances to keep more of your money over time. That may mean paying slightly more now to save yourself much more in the future. We incorporate tax guidance into your retirement income strategy to help you increase your after-tax cash flow – which enables you to do more of the things that are important to you.

Pay your taxes, but don’t leave a tip.

Your money can go four places:

- You

- Your loved ones

- Charities

- Taxes

What can you expect from us?

Tax efficient withdrawal and investment strategies to pursue higher after-tax returns

Withdrawing from taxable accounts first, then tax-deferred accounts, and lastly from tax-free accounts can lower your taxes over time. Placing tax-inefficient investments in tax-deferred accounts, high-growth investments in tax-free accounts and tax-efficient investments in taxable accounts can further reduce the tax drag on your investments.

Determine if paying dimes today can save you quarters in the future, e.g. Roth conversions

You may benefit from partial Roth conversions in years where your tax bracket is low to avoid higher brackets in future years.

Coordinate with you and your tax preparer to simplify tax preparation

Nearly all financial decisions affect your taxes. We help you simplify the process of gathering the information needed to file your tax returns.

Analyze your annual tax return for opportunities to improve

We use specialized tax software to analyze your tax returns for opportunities to lower your taxes this year and/or in the future.

Charitable gifting strategies, such as Qualified Charitable Distributions

Using Qualified Charitable Distributions (QCDs) can lower the taxable amount of your IRA distributions including Requirement Minimum Distributions (RMDs).