Investment Management

“The essence of investment management is the management of risks, not the management of returns.” – Benjamin Graham

We build your portfolio with low-cost index funds based on Nobel Prize-winning research and use disciplined rebalancing strategies to buy low and sell high, managing your risk over time. Rebalancing sounds simple, but it isn’t always easy. When stocks declined in 2008-2009 and March 2020 few investors wanted to sell bonds to buy stocks, but that was the wise move, and it’s what we did.

Investments based on evidence, not hunches.

The best portfolio is one you can stick with.

Investors want above average returns and many fund managers try to outguess the market. Unfortunately, roughly 80% of funds underperform their benchmark for periods longer than 5 years. Worse yet, the small number of funds that do manage to outperform in a 5-year period are just as likely to underperform the next 5-year period as any other fund.

Over 15+ years, a portfolio of 100% stocks is likely to outperform a 50-50 portfolio of stocks and bonds. But it can be more difficult to stay invested with 100% stocks. Technology enables you to check your investments anytime, but research shows checking more often makes it harder to weather volatility.

What can you expect from us?

Globally diversified portfolios tailored to your needs

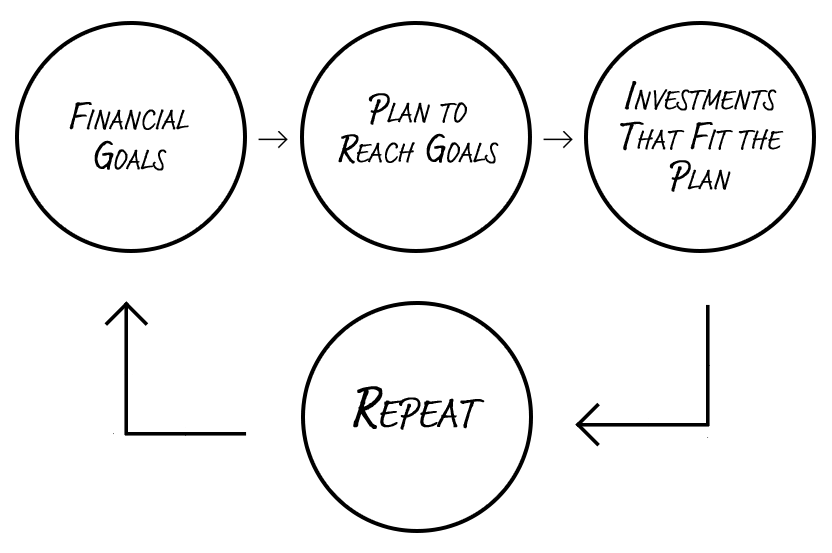

Broad market index funds allow you to own stock in virtually all publicly traded companies in the world, as well as bonds issued by many different countries. Your portfolio mix of stocks, bonds, and cash will be personalized to your specific financial goals and risk tolerance.

A clear understanding of your investments

Know the appropriate investments for short (cash), intermediate (bonds), and long-term (stocks) goals and the mix of your portfolio that is allocated to each category and why, based on your financial plan. Understand how the different tax treatment of your accounts affects the type of investments best held in each type of account.

Focus on controlling costs so you keep more of your returns

All costs matter when building and managing an investment portfolio: fund expense ratios, trading costs, advisory fees, tax efficiency, platform fees, etc. We are always looking for ways to keep these costs low and lower them when possible.

Insights into what is happening in markets and how it impacts you

We send clients periodic updates on the overall economy and investment markets. The updates are a combination of video, audio, illustrations and text that can be consumed in whichever way works best for you. We also provide an easy scheduling link if you would like to discuss anything in more detail.

We monitor your investments for opportunities for adjustments, so you don’t have to

Specialized software analyzes client portfolios and notifies us if they move outside the parameters we set for your mix of stocks and bonds. We trade your portfolio when market movements have created opportunities to re-balance.