Retirement Planning

Retirement planning is more than money; it’s the peace of mind to enjoy retirement.

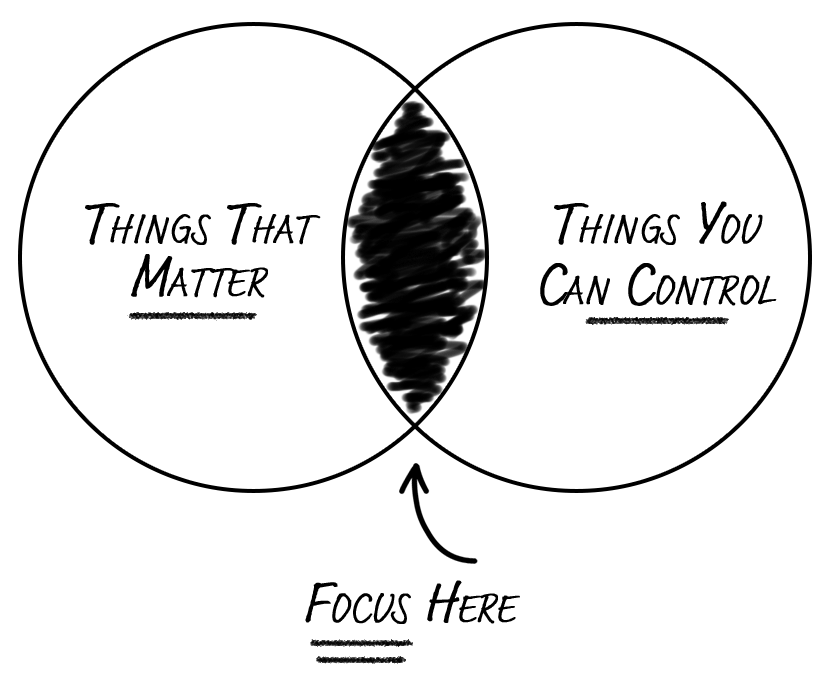

Many people have difficulty shifting their mindset from accumulation to distribution as they approach retirement. We help you create a clear strategy to generate reliable tax-efficient income so you can feel confident to do the things that matter to you, rather than worrying about your investments. Our approach works because it’s based on academic research combined with years of experience.

Like a Paycheck – Without the Work

What you CANNOT Control

- Market Volatility

- Investment Returns

- Inflation and Longevity

- Tax Rates

What you CAN Control

- Diversification and Rebalancing

- Investment and Advice Costs

- Social Security Strategy

- Tax Efficiency

What can you expect from us?

We get to know you and what matters most

Advice is only helpful if it is aligned with your unique values and priorities. We take the time to understand who you are and what is most important to you.

Retirement wisdom, not just financial advice

Retirement wisdom integrates various aspects of life to create a fulfilling and meaningful retirement. The focus is not just on financial security, but also on overall well-being and life satisfaction to build the confidence to stop putting off things you want to do that you can afford.

Strategies tailored to your unique situation

Your financial plan and investments are personalized to consider your specific circumstances, goals, and needs. By customizing your strategy to your unique situation, you can create a realistic plan that addresses multiple aspects of your life to create a secure and fulfilling retirement.

Analogies and illustrations rather than financial jargon

If it seems like many finance professionals are speaking a different language, it’s because sometimes they are. We are fluent in the terminology, but find communication is more effective with this goal in mind: “Everything should be made as simple as possible, but not simpler.” – Albert Einstein

Secure client portal access to see your investments and financial projections

See your updated financial projections, view your portfolio, and track performance by accessing our secure online platforms from our website.