April 2023 Market Update

Quarterly Market Summary

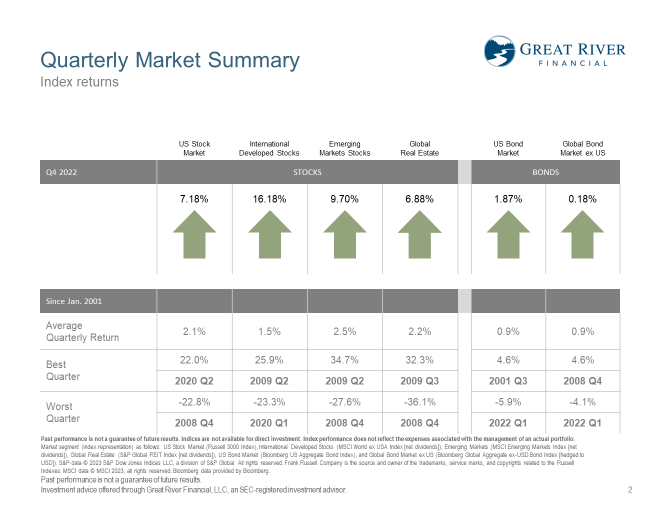

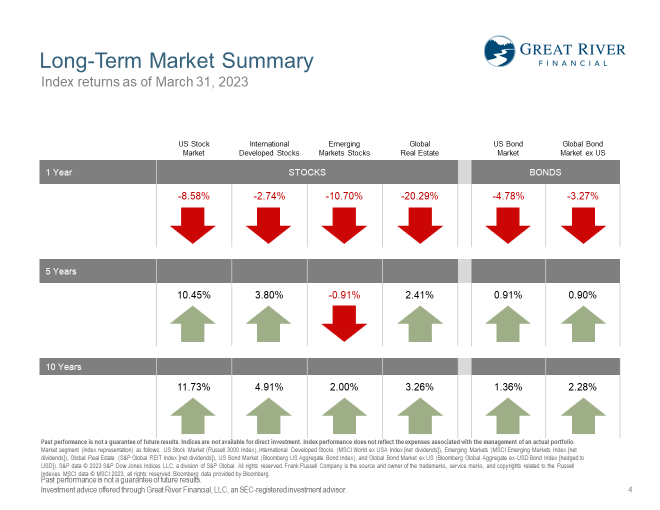

So, in the first nine months (the first three quarters of 2022) stock markets were down more than 20%, bond markets were down more than 10%, but really since then it’s been a completely different story. In the fourth quarter of 2022 stocks were up across the board – high single digits, even double digits in some markets, and bonds started to be positive in the fourth quarter of 2022, as well.

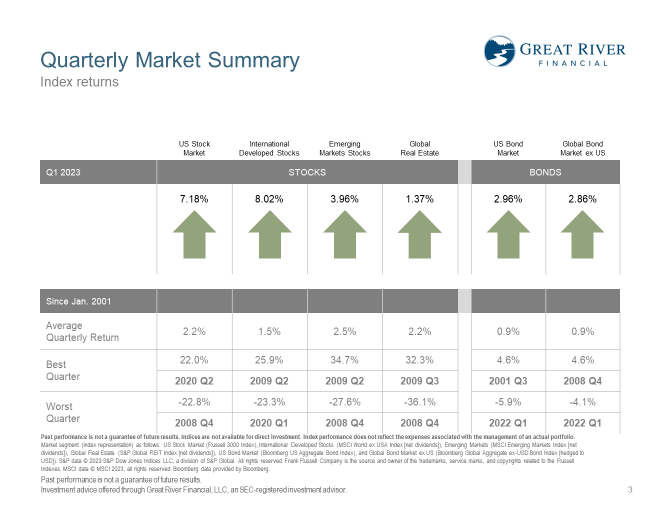

That good news has continued in the first quarter of 2023. Stocks again, across the board, were positive – high single digits for many of them and then U.S and non-US bonds, actually, were up about 3% in just one quarter in the first quarter of 2023, which is about 3x the long-term average of what we can expect bonds to go up by in a quarter. Now even though the last six months have been really good in markets compared to what we had before we’re still not quite back to where we were because about half of those decreases have been eliminated by the rebound in markets, which is good news, but still a ways to go.

Inflation

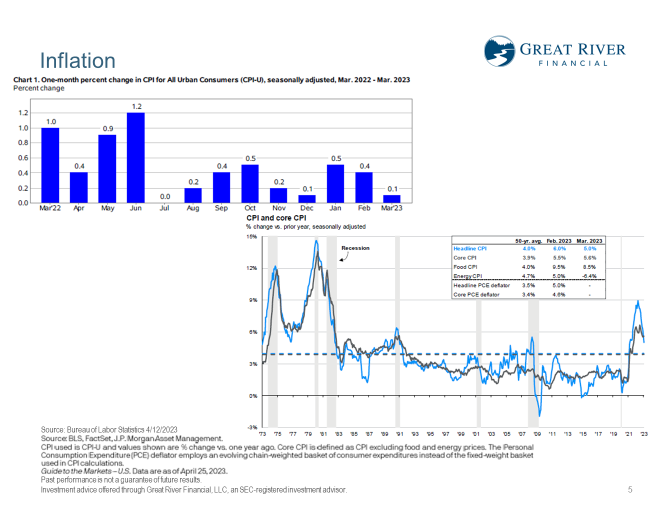

Let’s talk about the economic environment a little bit and what’s affecting both stocks and bonds. So, what’s been on everybody’s mind for much of the last 18-24 months is inflation. Inflation for much of the last 30 years has averaged between 2-3%, and it ticked all the way up to 9% in 2022, and it started to come back down, but still 5% year over year in the most recent reading in April. If we start to look at individual months, so March of 2022, there was 1% month-over-month inflation. If we had 1% inflation every month for 12 months we would have inflation over 12%. Really since July of 2022 though, so nine months at this point, we’ve averaged about a quarter of one percent per month, so a quarter of one percent per month of inflation over a 12-month period is a little over 3% inflation, which is a a huge turnaround. A huge decrease in what inflation has been. It’s not where we want it to be per se, but by the end of 2023 we could really see inflation readings of 2% – 3% year over year before the end of 2023, which is good for markets, good for economies and we’ll talk a little bit about that on the next slide around interest rates.

Interest Rates and Banks

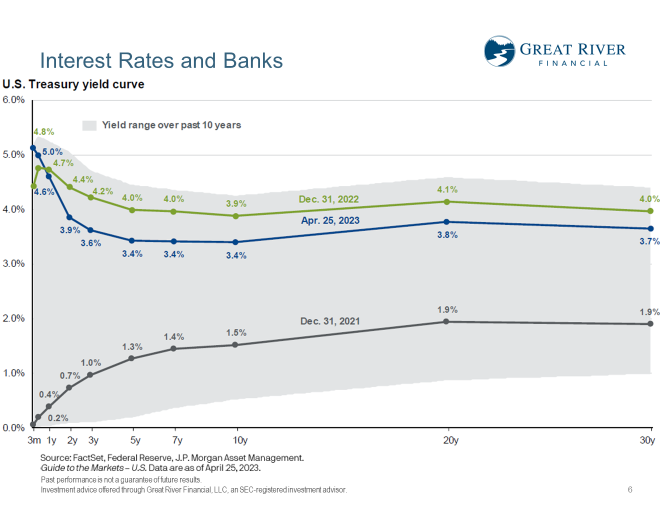

When inflation is low interest rates tend to be low. When inflation starts to tick up interest rates start to tick up and we’ve really seen that in 2022 and in 2023. At the end of 2021 we actually had interest rates (short-term interest rates) basically 0%. As inflation started to go up the Federal Reserve started to increase short-term interest rates and now we’re all the way up at 5% for short-term interest rates. But, you’ll see the long-term interest rates went up, but not quite as much. So, long-term interest rates at the end of 2021 were between 1 ½ – 2%, now they’re between 3 ½ -4%. You’ll notice that at the end of 2022 long-term interest rates are a little higher than where they are now. That’s good for a couple reasons. One is it means inflation expectations by investors has gone down a bit. It also means that if you’re trying to buy a house, you’re trying to buy a car, a boat, you’re trying to expand a business, if you’re borrowing money to do something economic in the world, long-term interest rates have come down a little bit, which is good for economic growth compared to where it was four months ago because inflation expectations are lower. When short-term interest rates are high and long-term interest rates are low that’s good for savers and it’s good for borrowers, but it’s not good for banks. If you want to simplify how a bank works – they basically borrow at short-term interest rates and lend at long-term interest rates plus a spread.

So, in 2021 they were basically paying you 0% on your savings account and they were lending money out at 3%, 4%, 5% for cars, businesses, things like that. Now they’re having to pay you 3%, 4%, maybe 5% on certificates of deposits and savings accounts and things like that and they’re only able to get something like 5-6% on their mortgage portfolio or maybe 7-8% from businesses, so they’re not making as much as they have in the past, which means their capital is not growing at the same rate as it has in the past. This is different than the banking challenges we faced in 2008 and 2009 when banks loaned a bunch of money to individuals, to entities of businesses, not for profits that didn’t have the money to pay it back over time. This is more like the Savings and Loan Crisis of the 80s and 90s where we had short-term interest rates higher and long-term interest rates lower than that’s rough for banks. But, as inflation comes down the and FED may decrease short-term interest rates that could be alleviated. Also, I’m not too worried about banks from the standpoint as long as you keep less than $250,000 in there it’s FDIC insured. Schwab has been in the news – clients of ours really don’t have any money, or next to no money, in Schwab Bank itself. Most of the money is invested in mutual funds and in exchange traded funds. You own those in trust at Schwab, so Schwab doesn’t have those things. Schwab actually makes money off trading; they make money off, basically, when you have cash there they’re lending it out at a higher interest rate. That’s really how they make money and the short-term interest rates being higher is good for Schwab, so I have no qualms about them, and even if something did happen to them, unforeseen, your money and investments are still separate from Schwab.

Consumer Confidence

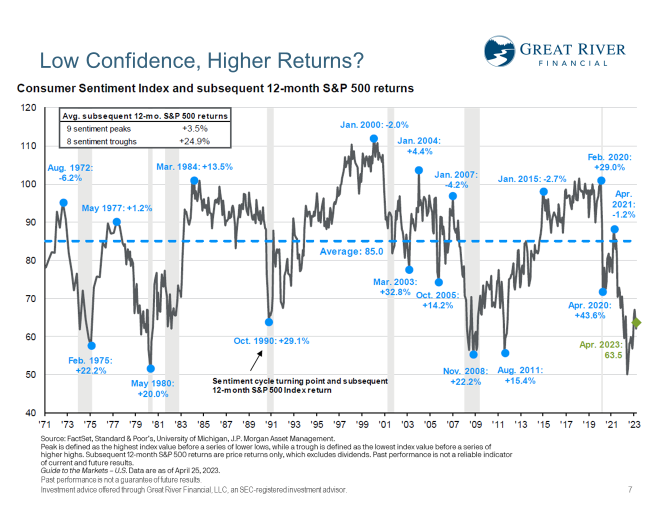

All right, so let’s talk a little bit about consumer confidence and what that might mean for future returns on stock markets. Investment markets in general are quite counter-intuitive. The times when we are most concerned about economic growth are actually the times right before markets tend to do well. In the times where we think everything is Goldilocks, everything is good, inflation’s low, growth is high and consumer confidence is really high, stocks are at such a high price that any bad news tends to be bad for them. If we look at the last 52 years and we look at sentiment peaks, so consumer sentiment or confidence, and we have all these peaks over time, so nine of them, the average return on the S&P 500 the 9 – I’m sorry the 12 months – after those 9 Peaks are 3 ½%. Still positive, so even when confidence is really high and lower expected returns are still positive expected returns. But, if we look at these sentiment troughs, actually, the average return is almost 25% over the next 12 months, which is somewhat unbelievable. When you think about these times, we were in a deep recession in 1990, we were in a deeper recession in 2008, actually the average returns over the next 12 months were much better than they were before the recession started When confidence was much higher. You’ll notice when we look at consumer confidence the lowest reading in the last 52 years was actually right at the end of 2022 right at the beginning of 2023. Now I’m not calling for a 25% increase in stocks over the next 12 months from that period, but low confidence, which many of us are feeling in the economic environment right now isn’t necessarily bad news for the stock market. In fact, historically, it’s been good news.

Corporate Profits Drive Long-Term Returns

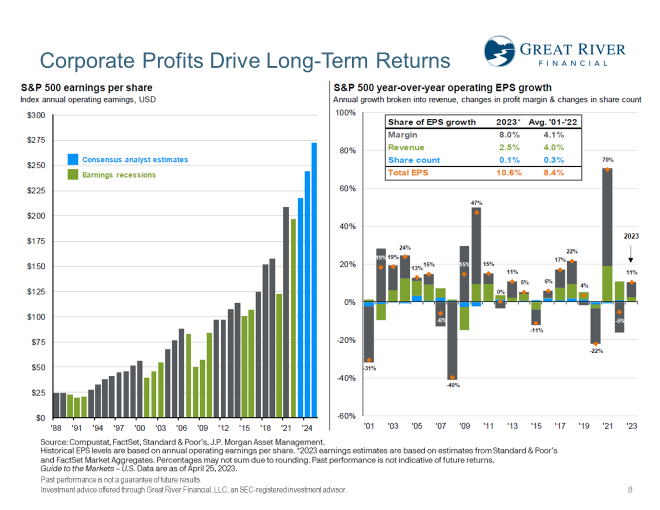

What really drives long-term returns in stocks are corporate profits and those have been quite good in 2023. In 2022 we had an earnings recession, basically, earnings went down 5% year over year on average across the S&P 500. They’re up 11% so far this year. Now it doesn’t mean the markets are going to keep doing that all year, but even in this challenging environment corporations have been able to, basically, cut expenses. You see this in a lot of the tech companies. They’re laying off lots of developers and what they’re actually providing, like Facebook is providing no less stuff now with half as many or a third less programmers than they had a month ago. This is true of a lot of businesses that their margins have actually done better as they’ve – I’m not calling for layoffs, but it’s good for corporate profits to be more concerned about expenses. That’s really good for corporate profits, which is good for long-term returns.

What’s Next

All right, so what’s next? We’re going to continue to monitor markets and do film updates like this over time. We’re going to rebalance portfolios, as needed. We’re going to manage cash, as needed. So, if you’re getting withdrawals over time, monthly in retirement, we’re going to make sure you have enough cash for about six months worth of that. We’re going to rebalance portfolios – if stocks go up, bonds go down – we’re going to sell stocks high, buy bonds low. If the opposite happens, we’re going to do the opposite. We’re going to continually, in a disciplined manner, buy low and sell high. If you like this video you can subscribe, you can like, you can share it, or do all three. Thanks for watching. This is Josh Wolberg with Great River Financial – stay curious my friends.