November 2022 Market Update

Quarterly Market Summary

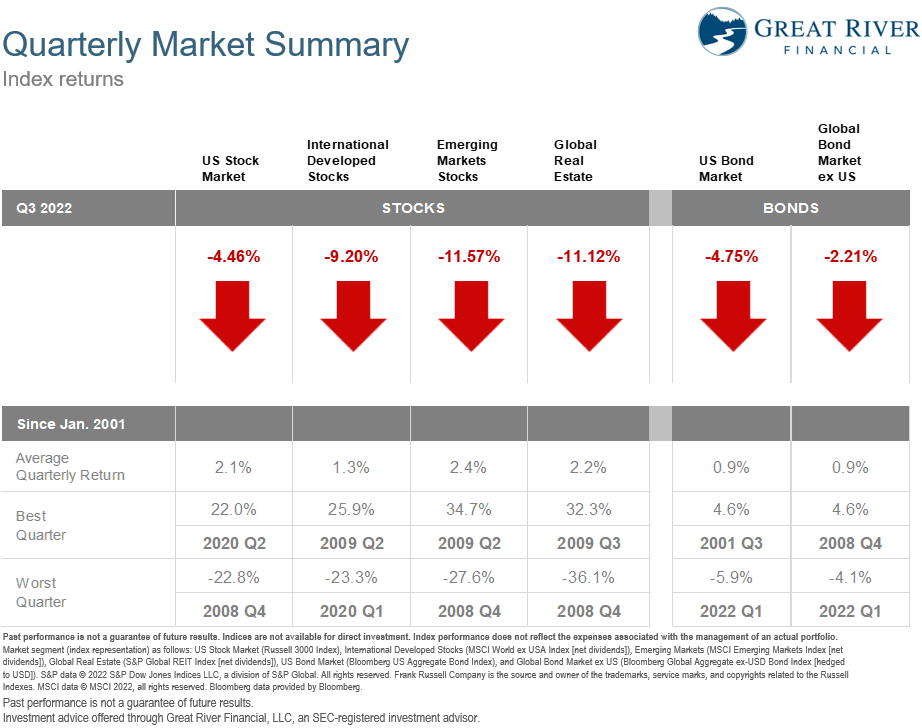

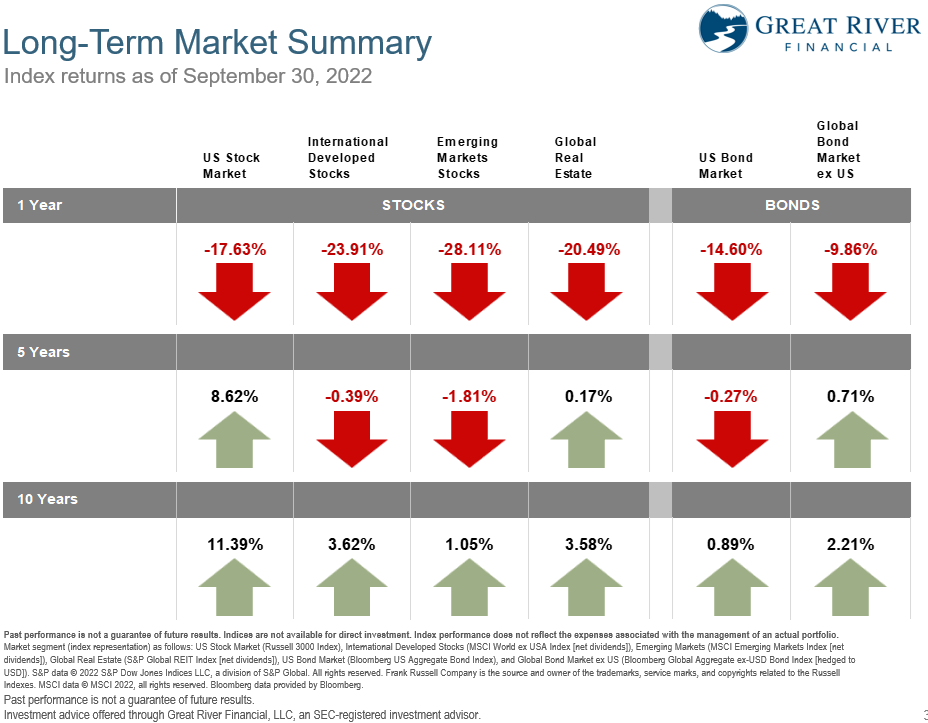

In the third quarter trends continued – U.S and non-US stocks, and bonds all went down in the third quarter as they did in Q1 and Q2. Stocks were down more than bonds. If we zoom out a little bit more and we look at the one-year numbers, which includes the fourth quarter of 2021, a diversified portfolio of global stocks is down basically 20 – 25% and bonds 10 – 15% percent. Now it’s not that unusual for stocks to be down 20 – 25% in a 12-month period. We’ve experienced that multiple times in our investing lifetime; bonds being down 10 – 15% is new and somewhat unusual. We’ll talk about some of the historical context for both stocks and bonds, we’ll also talk about some possible optimism going forward (even though 2022 has been, obviously, a very challenging year).

Stock Market

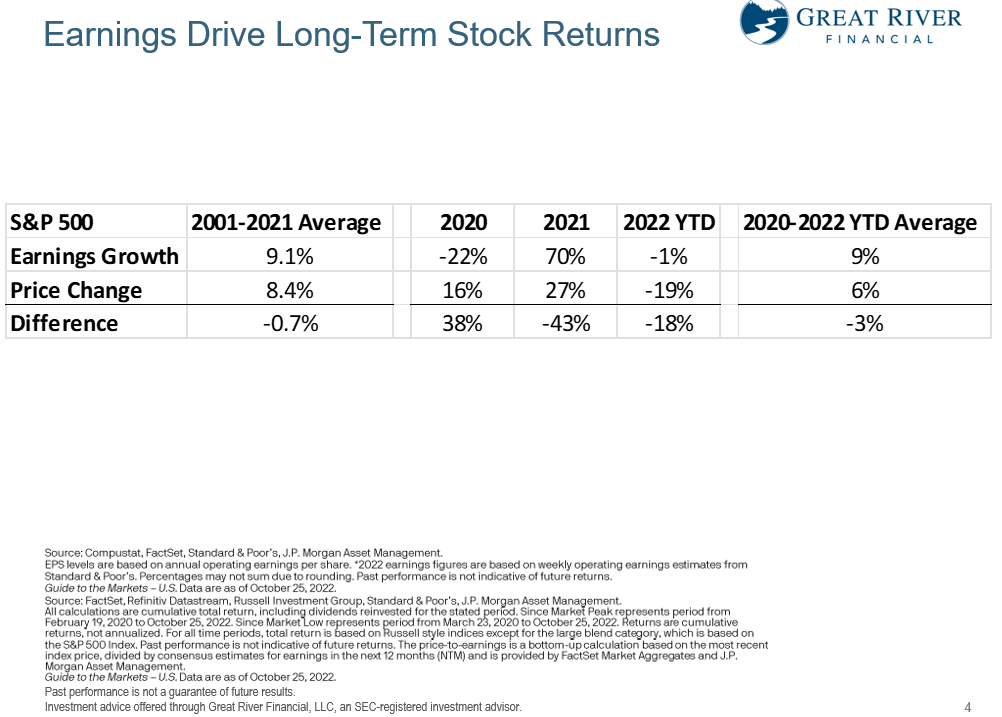

All right, so what really drives long-term stock returns are earnings growth on the underlying companies. If you look from 2001 to 2021 there’s been about a 9% increase in earnings on average of the S&P 500 companies and the returns have been about 8.5%, so less than a 1% difference, so the market tends to be quite rational and logical over a long period of time. Individual years though there can be a big disconnect. In 2020, the first year of the pandemic, earnings on the S&P 500 actually shrunk by 22%, so it declined. Even though stock prices went down 30% in just March of 2020 alone it more than recovered by the end of the year and was up by 16% overall, so about a 40% disconnect between earnings and stock prices. Now what some people were predicting in 2021, as a result, is stock markets were going to go down as a result of bad earnings growth or shrinkage in 2020. What actually happened in 2021 is earnings growth accelerated to 70%, which means that almost doubled year-over-year earnings on the S&P 500 and prices of stocks only went up by 27%. I say only because it’s a 40% disconnect between what actually happened in earnings. Now in 2022 earnings are basically flat and prices are down 19 – 20%, depending on the day that we’re looking at, so over the last three years we basically had earnings growth of about 9% on average. Although, obviously, very volatile and prices have not kept up with it. So, what’s likely to happen in the future for stock prices is really a function of what happens to earnings. If companies continue to innovate, come up with new products, new services that they’re able to market to new customers; their revenue will go up if they can figure out a way to do that efficiently from a cost perspective their earnings are going to go up over time because revenue grows more than expenses do.

Bond Market

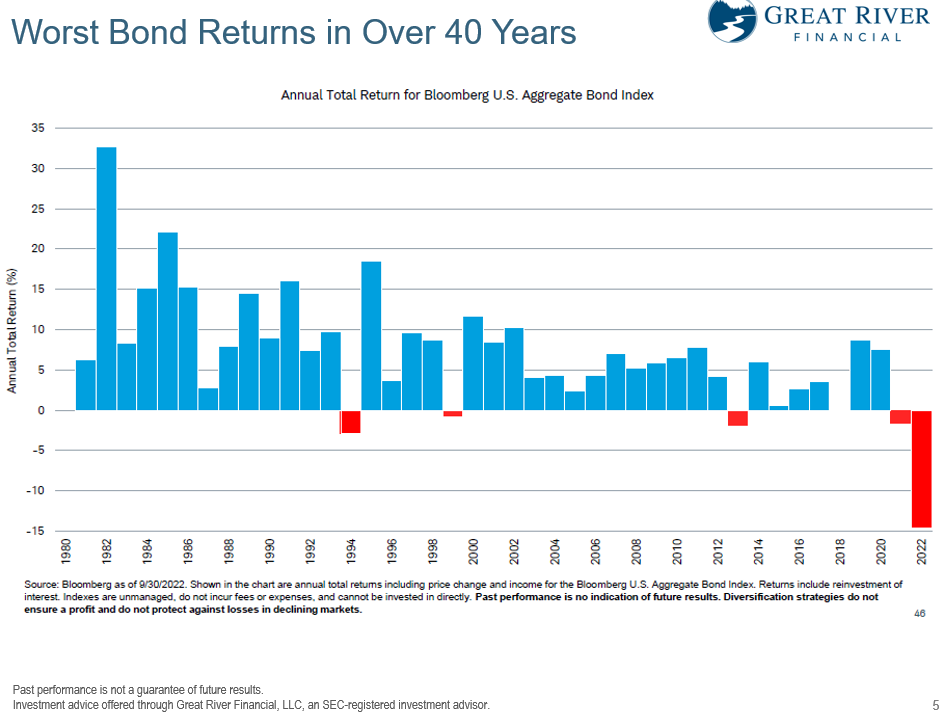

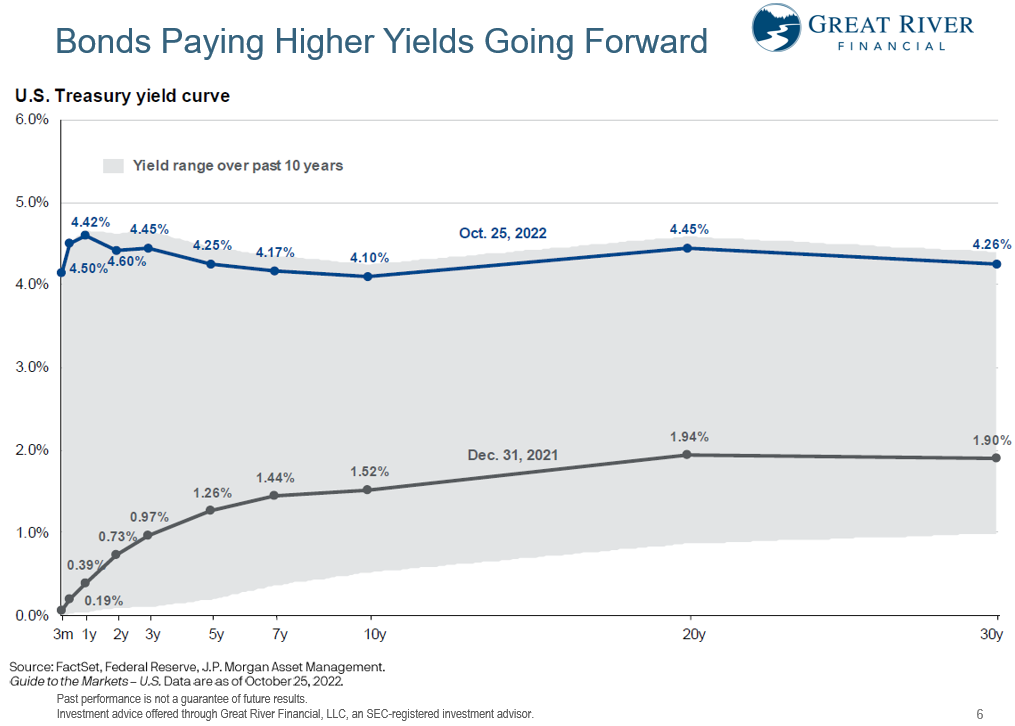

When we look at the bond market, there’s a real disconnect here between what’s happened in in market history. There’s a real outlier – 2022 being down almost 15% in U.S bonds. You’ll look at just the last 40 years – it’s very seldom to have a negative year in bonds, at all, let alone more than a percent or two, and this is really the worst bond performance of any of my client’s lifetimes. There is a silver lining though; just as earnings in the future tend to drive future stock market performance, interest rates today tend to drive future bond performance. So, if we look at interest rates that have gone up dramatically this year a five-year treasury bond at the end of 2021 was only yielding 1.25%, now that same bond is yielding 4.25%, so 3% more per year. Even though it’s been really unpleasant having bond prices go down 10 – 15% this year, if it gets another 3% per year through higher interest rates over the next five to ten years you can actually end up with better returns on bonds the next 10 years. As a result of what’s happened this year, bond prices going down and interest rates going up, because interest rates are similar to earnings in stocks they’re a big component of future bond performance.

Inflation

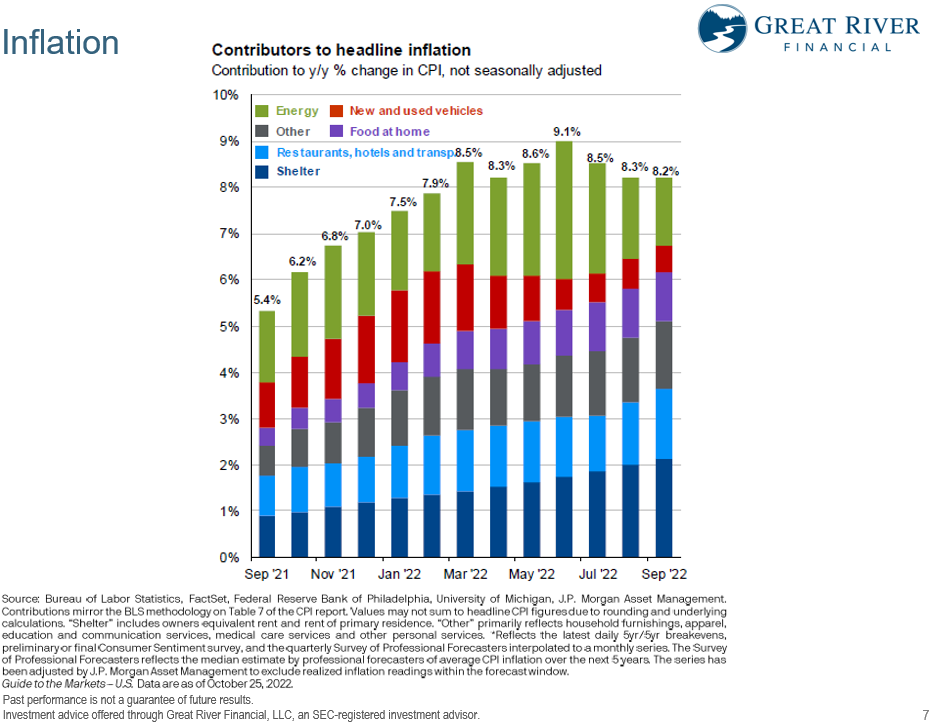

Why have interest rates gone up so much? It’s really inflation, right? Inflation you’ll see started to go up really in the beginning of 2021 and kind of reached a crescendo in mid-2022. It has started to come down a little bit. The FED is trying to increase interest rates to tamp down the growth in demand for goods and services, not necessarily cause a recession, but to slow the growth of demand as we come out of the pandemic – economically at least. Supply chains aren’t quite where they were in 2019 yet; there’s a lot of improvements there, but they’re not quite to where they were. Prices are all a function of supply and demand. Demand continues to grow even though the Fed’s trying to rein it in a little bit, and supply hasn’t gone back to where it was, so that’s really why inflation is still relatively high even though it’s started to come down. It’s going to take some time to get through, the fact that interest rates take time (there’s a lag), as well as it’s going to take some time to get supply chains back to where they were.

60/40 Portfolio

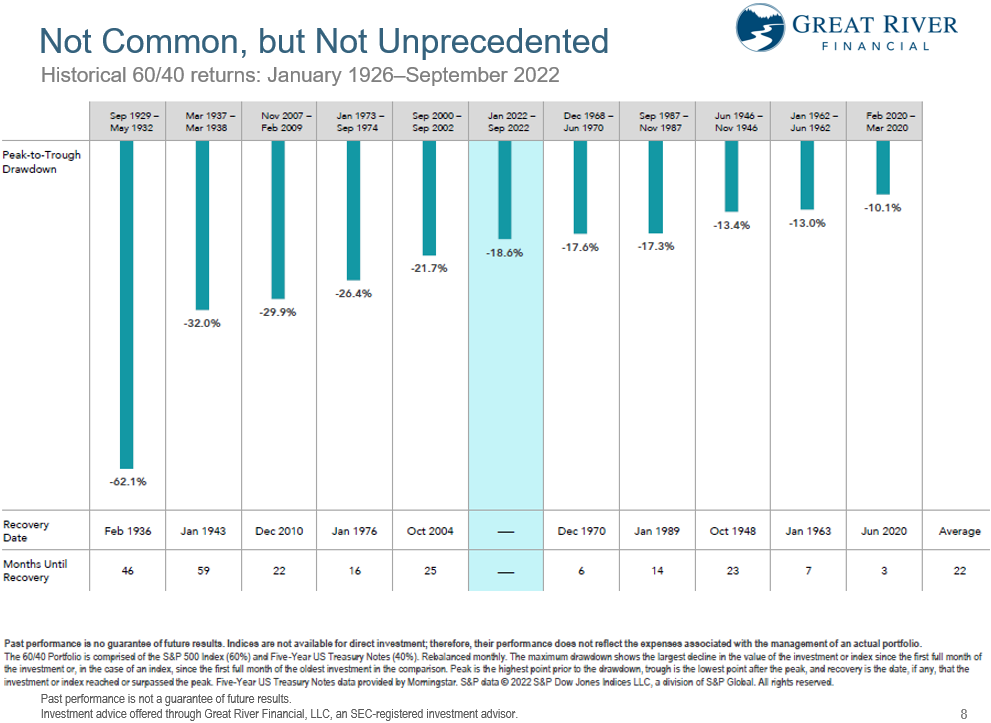

Let’s look at a 60/40 portfolio – 60% stocks, 40% bonds. It’s not unprecedented for it to be down 10%+ in a particular period, but it’s not exactly common either. It’s happened about 11 times in U.S history over the last hundred years. When we look, the Great Depression are obviously the two worst of those. How long does it take to recover during a time like that? It took about four years the first period of the Great Depression and about 5 years the second period of the Great Depression. All these other times are basically two years or less. I’m not saying the recovery from this is going to take two years or less. History doesn’t always repeat itself perfectly, but it does tend to rhyme. When markets turn around (both stock and bond markets are likely to turn around at some point), when that happens the recovery might be faster than we expect and the recovery in investment markets might come before the recovery in the economic markets. In fact, that happens a lot. If you think back a few slides when we’re talking about 2020, even though the earnings in the stock market were down in 2020, the market went up and the earnings acceleration didn’t really happen until 2021. A lot of times that’s how it happens when we have a recovery – the market starts to perform better before we have good news in the economy. Again, we don’t know that’s what the future holds, but the past does give us a lot of input on how these things usually play out.

Investing in Volatile Markets

So how do we invest in a volatile market? The same way we do in every market. We make sure that clients who are taking money out of their investments have enough cash and enough bonds for short and intermediate term needs. So for the next year, the next one to ten years for bonds, to have enough in there to weather storms in the market. Dividends and interest, do we reinvest them or leave them in cash? It depends on your situation. If you’re in retirement, we’re going to leave them in cash and they’re going to replenish that buffer of cash. If you’re in an accumulation stage, as dividends and interests come in, we’re going to reinvest that in the part of the market that you don’t have enough of depending on what’s happened in both stocks and bonds. We’re going to rebalance over time, so if you get out of balance – if your target’s 80% stocks and 20% bonds and stocks continue to do worse than bonds, we’re going to need to sell bonds and buy stocks at lower prices, and vice versa, when stocks recover, they’re likely to recover better then bonds, so we’ll sell stocks, as they go up to replenish the bond portfolio. Roth conversions make sense for a lot of clients every year, but particularly in a year where there’s a decrease in prices, because we can do the Roth conversion and convert more shares because prices are down. Then when the recovery happens more of it can happen in the Roth IRA. So, expect if we’ve done that in the past, or we’ve talked about it in the past, that we would do it this year. Expect a call and some emails before the end of the year.

How do we invest?

- Buffer of cash/bonds for short/intermediate term cash flow needs

- Dividends and interest: reinvest or leave in cash?

- Rebalance

- Roth conversions

- Getting more out of your cash (that isn’t in your emergency fund)

- Extra payments on debt with variable interest rates

- I Bonds

- Dollar cost average into diversified portfolio

Getting more out of your cash

Basically, money that’s not in your emergency fund, what do you do with it? There’s kind of three options and I’m putting them in order of what I would consider doing.

1. Extra payments on debt with variable interest rates. If you have credit card debt, that interest rate is going up pretty dramatically based on short-term interest rates. Pay that off as soon as possible.

2. Once that’s done you might consider inflation protected bonds. These are I bonds. Savings bonds from the government directly. You can go on www.treasurydirect.gov. I cannot buy these for you, you can buy them on the website. It’s basically $10,000 a year per person that you can put into it. So, $10,000 in 2022, if you’re a married couple for each spouse, and then $10,000 each in 2023. You each need your own individual account at treasurydirect.gov. If you have questions on that let me know. Basically, they’re saving bonds that are designed to keep up with inflation, so the interest rates right now are over 6%.

3. Then dollar cost average into a diversified portfolio. If you have cash on the sidelines and you’ve already done these two other things, it might make sense. I don’t know when markets will recover, but it might make sense if you’ve got $50,000 in cash to do $10,000 a month for five months into a diversified portfolio, so that if prices recover in investments, you’ll have had some of that money in the market. If prices continue to go down, you’ll buy it at better and better discounts for the eventual recovery.

People ask me, “Is now a good time to get in the market?”. Well, the answer is always “Yes”. Even when markets are going down, or when markets are going up, because the expected return in both stocks, bonds and cash over time are positive. We don’t know what they will be in the short term, but long term they’re all positive.

What’s Next

We’re going to continue to monitor markets. We’re going to make updates like this from time to time. We’re going to rebalance portfolios, manage cash as needed. If we haven’t done a client review this year feel free to schedule one. There’s some links in the email that I sent this out on that you can schedule a review. Either a call or a more in-depth review, depending on what you have time for. Thank you for watching. My name is Josh Wolberg with Great River Financial. Stay curious my friends…