February 2025 Market Update

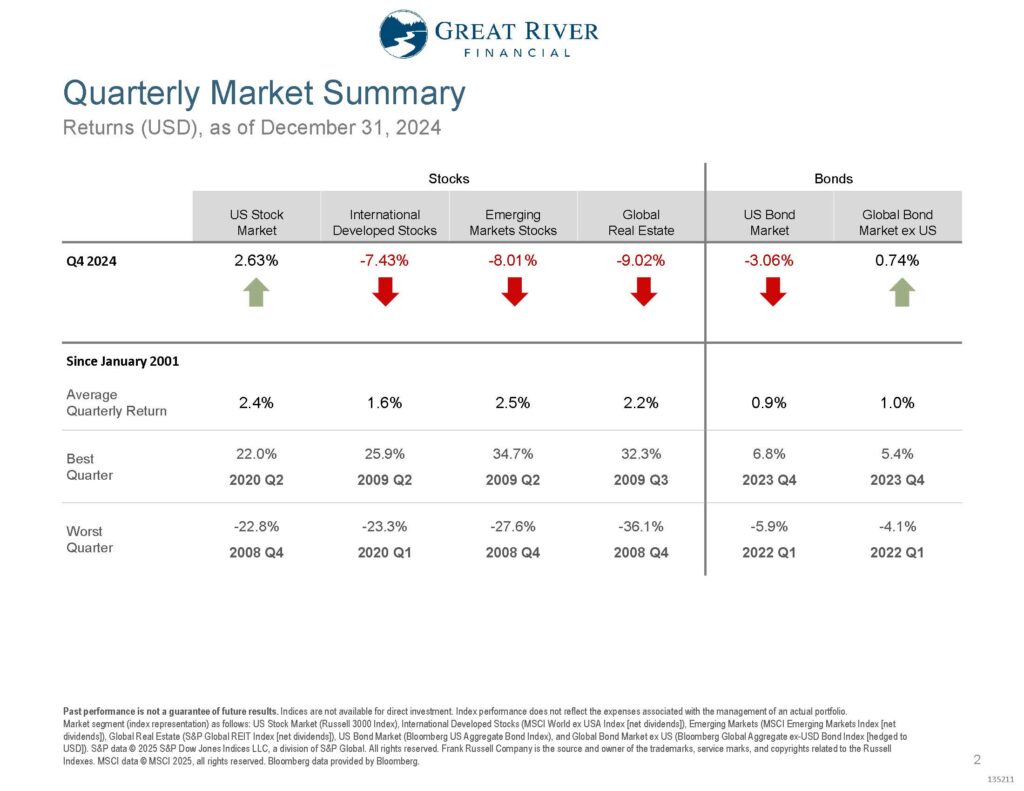

Quarterly Market Summary

Markets around the world were volatile in the fourth quarter of 2024. While US Stocks and Global Bonds were up in the fourth quarter, International Stocks, Global Real Estate and US Bonds were all down in the fourth quarter of 2024.

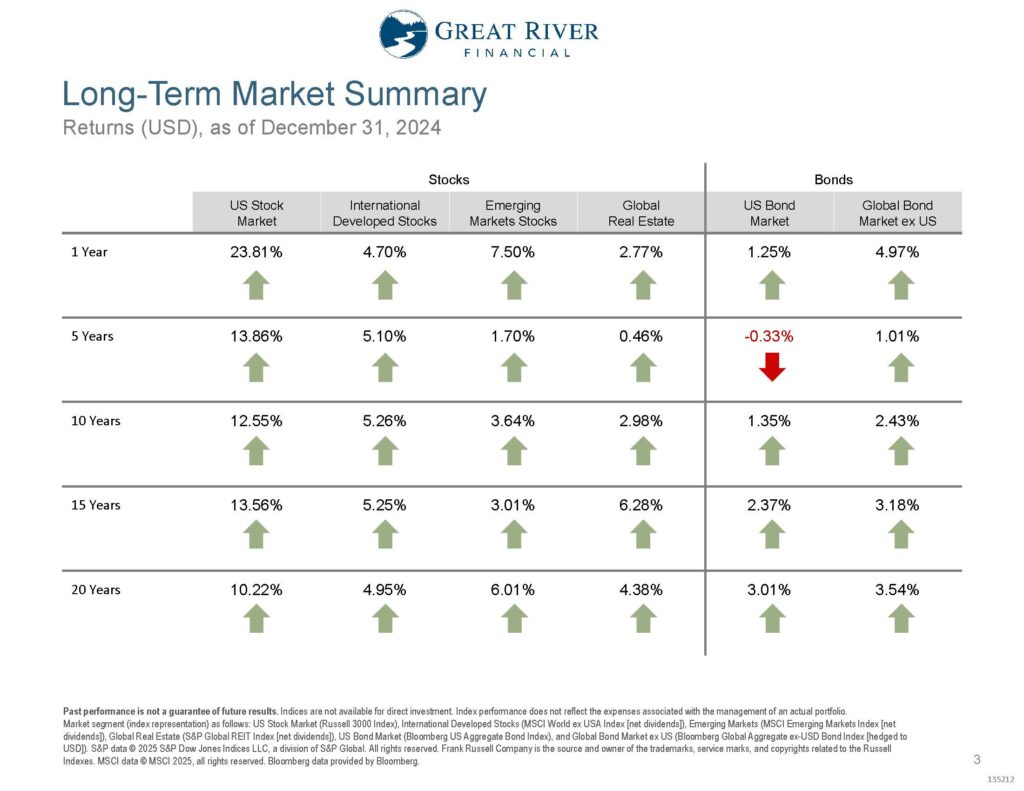

Long-Term Market Summary

When we zoom out and look at the full year of 2024 you’ll see that market were up across the board, including the US Stock Market being almost 24% and Global Bonds being about 5%, which are both kind of at or above their long-term averages and International Stocks, Global Real Estate and the US Bond Market being below their long-term averages, but still above zero from 2024. So, all in all 2024 was a pretty good year for markets in the US and around the world.

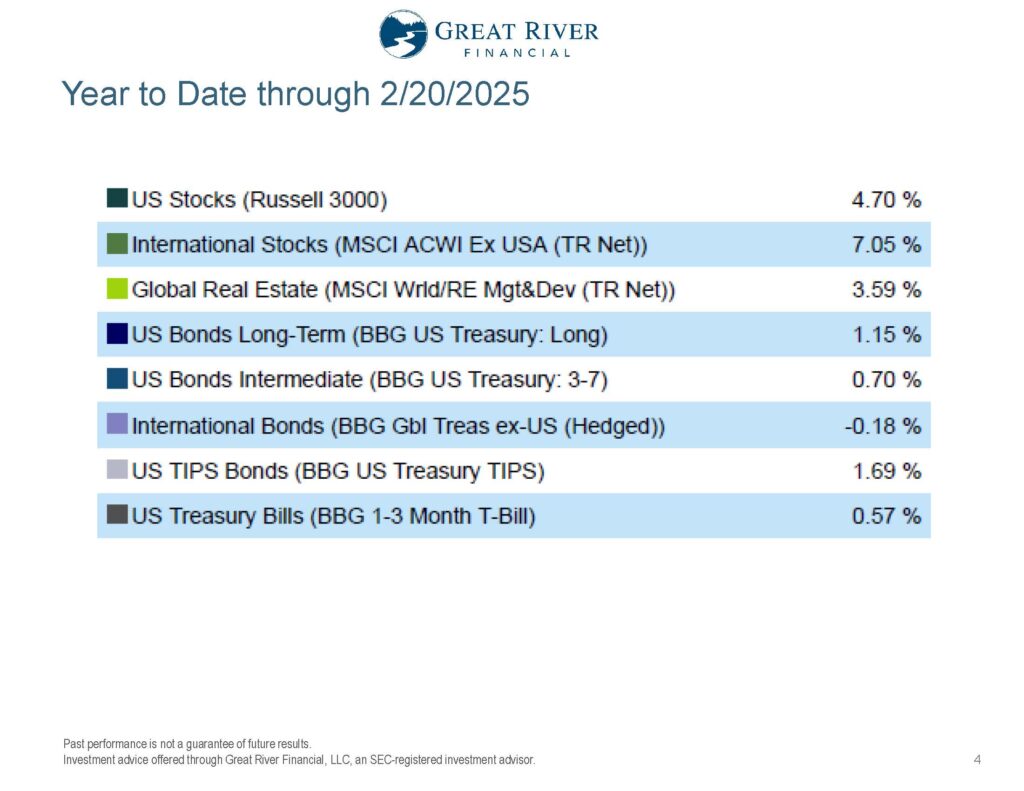

Year to Date through 2/23/2025

When we look at 2025 year-to-date US and non-US Stocks and Bonds are up across the board. Now, it doesn’t necessarily feel this way to most investors and a lot of that is how we get information from media. The media tends to focus a lot more on negative news. That’s true not just with financial news, but any news across the board. They tend to focus a lot more on negative days than the next day when the markets rebound, so even in a year where International Stocks are up almost 7% in less than 2 months in 2025 it, certainly, doesn’t feel like that to many investors.

Vanguard 10 Year Average Return Projections

So, that is what has happened over the last year in markets. What do we expect to happen going forward? Now, it’s really difficult – I would say impossible – to project what’s going to happen in any individual year in markets, but over a longer period of time (10+ years) it’s a lot more reasonable to have an expectation of a range of average returns in major investment classes. This is Vanguard’s 10-year average return projections for major asset classes around the world. Now, what they’re expecting, because US Stocks have done so much above average the last 10 years, is that the next 10 years they’ll be slightly below average so, anywhere from 3-5%. Whereas US Bonds they expect somewhere between 4-5% with about a third as much volatility. So, actually, bonds do have a slightly higher average expected return than US Stocks. Now, when we look at US Value or US Small Cap Stocks, where the index funds that we use, tend to have more than the index itself does. They expect those to do a little bit better than US Stocks, on average. In International Stocks they expect somewhere between 7-9% the next 10 years, on average, which is a lot closer to its long-term averages. Then US inflation is somewhere between 2-3%, which is closer to its long-term returns. Now one thing I’ll say about an average return over a long period of time is when we say an average return is between 3-5%, what most people hear is that it’s going to be between 3-5% most individual years. But, how it really works is more like the average temperature here in Minneapolis year round is 48 degrees, but it’s almost never 48 degrees. It’s way hotter in the summer, way colder in the winter and markets aren’t as predictable as season temperatures. So, when we think about an average return between 3-5% there’s going to be some years that it’s probably above 20% and some years where it’s down 20% and it’s virtually impossible to predict between those two. We expect US Stocks to do slightly worse the next 10 years than they did the last 10 years, but still positive and above inflation. Bonds and International Stocks to do better than they have the last 10 years.

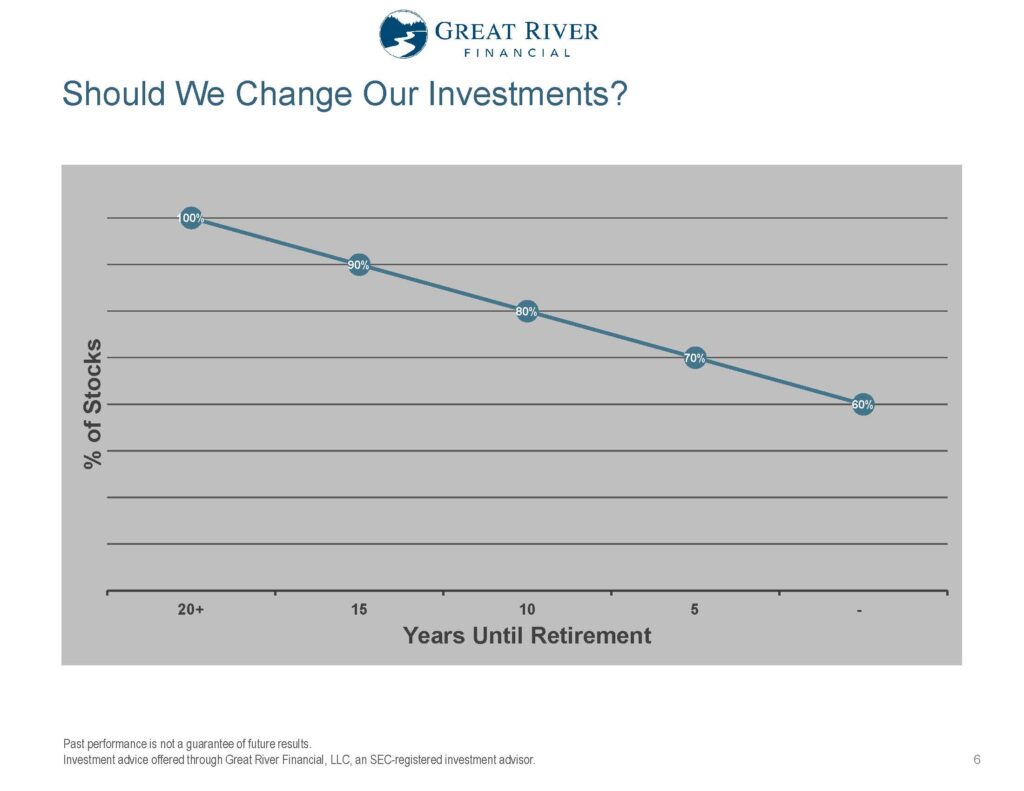

Should You Change Your Investments?

Based on those 10 year expected returns, you may wonder, “Should you change your investments?”. It really depends on your own financial plan and when you’re planning to use the money when you plan to retire. In this hypothetical case, which is true for most of our clients, they tend to have a high percentage of stocks when they’re 20+ years away from retirement and then slowly over time lower how much they have in stocks and increase how much they have in bonds until they’re somewhere between 40-60% stocks at retirement age. In this plan if somebody, say this hypothetical client, is 14-15 years away from retirement and maybe they’re at 100% or 90% stocks. Given where stock prices are relatively high compared to historical averages, and interest rates being much higher than they’ve been in the past, it may make sense for this client rather than waiting until 10 years out is kind of “sooner rather than later” moving from 90% to 80% because it fits within their plan. The plan wouldn’t be to move from 90% to 80% and then if and when stock prices go down, to move back to 90%. You would make the next step down this ladder sooner rather than later. This something we’re going to be talking to clients a lot about in 2025. Does it make sense to ratchet down one or two levels of stocks as we get closer to retirement. Maybe your situation has changed, maybe you’re closer to retirement than you thought, maybe it makes sense to move one leg down. If it’s something you want to talk about before our annual review, schedule some time with us. We’d love to chat.

Key Takeaways

Some key takeaways. Stocks and Bonds were both up in 2024 and so far in 2025, even though markets tend to overreact to noise and there may be higher volatility going forward. We expect US Stocks and Bonds to have positive returns over the next 10 years, even though those returns might be very similar to one another. We also expect that International, because of their low prices, may have higher than average returns the next 10 years. It’s always important to stay diversified and have an investment mix that supports your plan in any market environment and you may want to lower your percentage as you approach retirement. As always, if you have questions feel free to shoot us a call, schedule a time with us, send us an email. We’d love to chat with you.

I’m Josh Wolberg with Great River Financial. Stay curious, my friends.