2025 Spring Market Update

May 2025 Market Update (edited video transcript)

Hello, this is Josh Wolberg with Great River Financial, and this is the first quarter update of 2025 or what we like to call “What in the World Happened?”

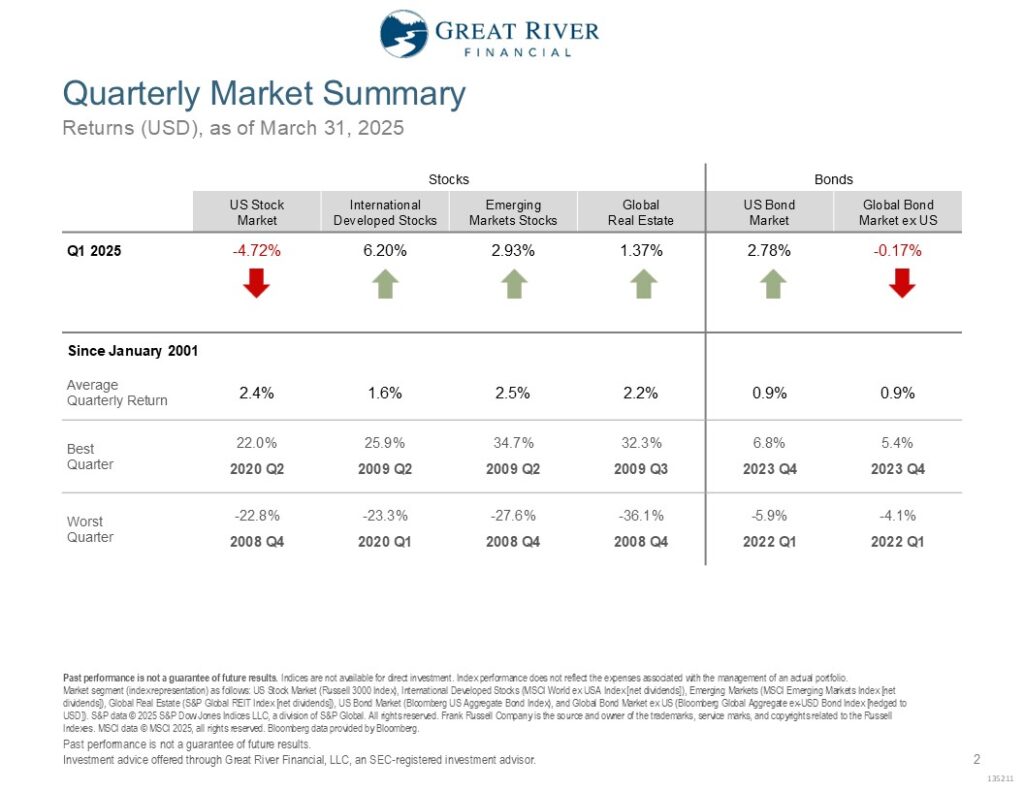

Quarterly Market Summary

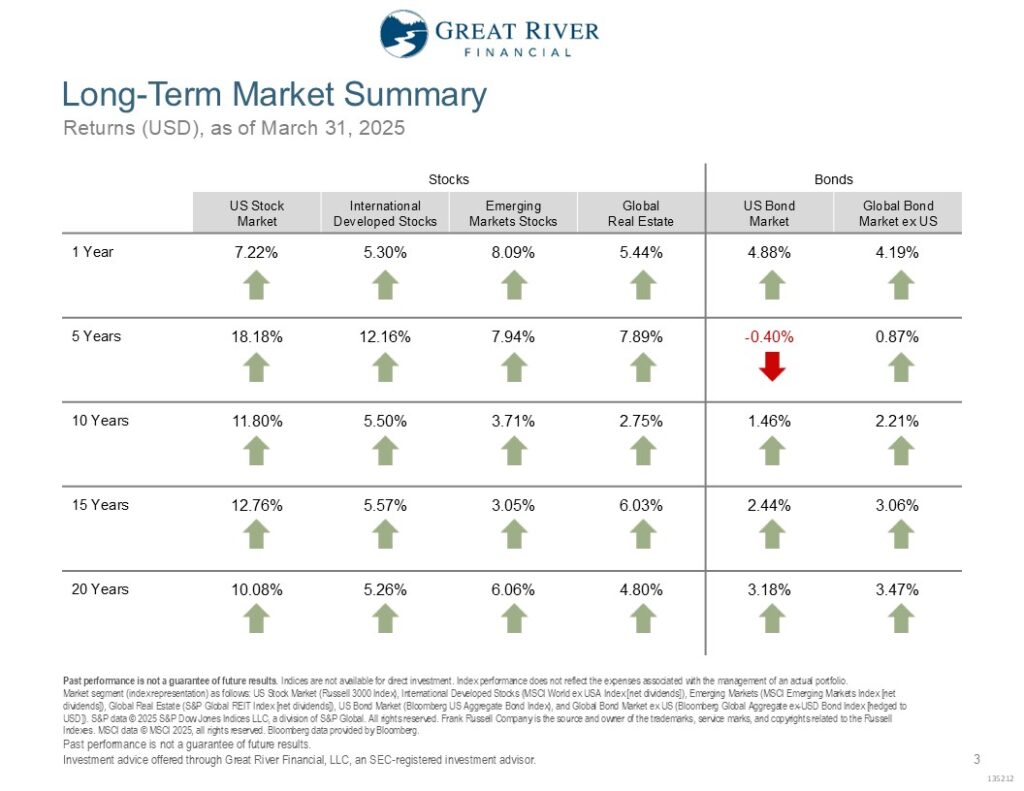

In the first quarter US Stocks were down while International Stocks and Global Real Estate were up. In the Bond market it was the opposite, where US Bonds were up and International Bonds were down for the first quarter. When we zoom out a little further and look at the one-year number ending in March of 2025, US and non-US stocks and bonds are all up between 4 – 8% in the last 12 months.

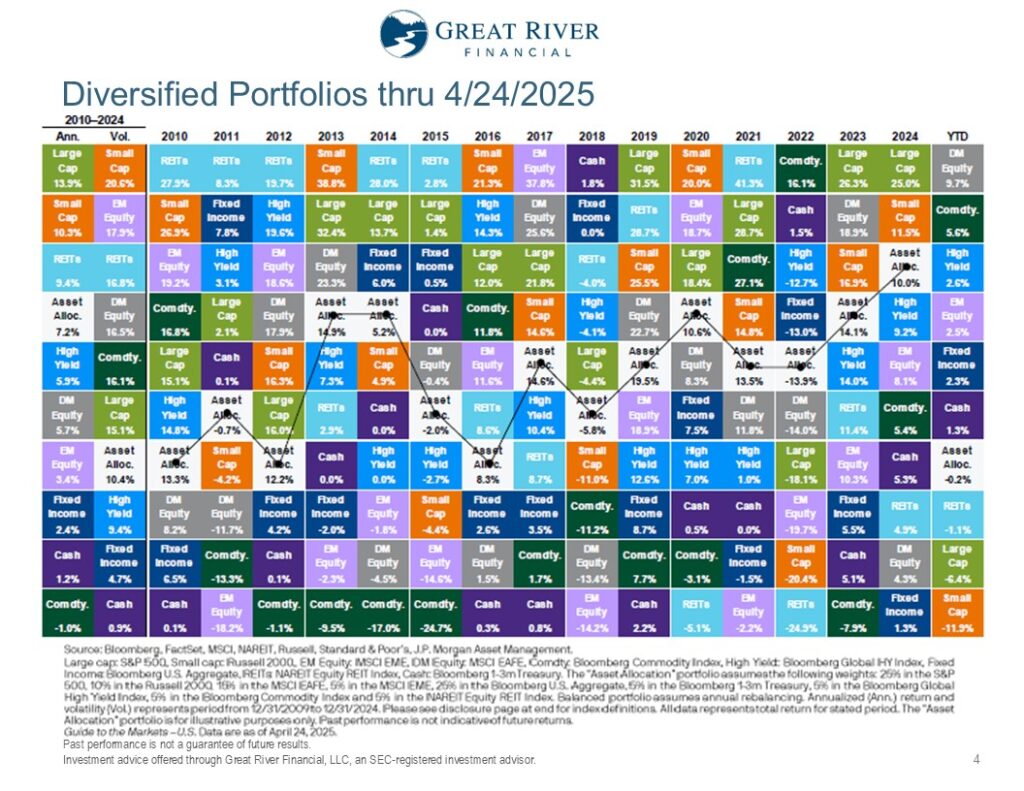

Diversified Portfolios through April 24, 2025

With the announcement of tariffs right after the first quarter ended April’s been a relatively volatile month. So, we’ve had down days followed by up days and kind of going back and forth between those extremes the entire month of April and through the 24th of April. What that means is US Stocks are down a little bit more than they were through the first quarter, but International Stocks have, actually, been up more since the end of the first quarter. And bonds are basically flat since the end of the first quarter, so, up for the year about 2%. Now when we look at a diversified portfolio, so about 60% stocks and 40% bonds, it’s been relatively flat year-to date through 2025 – even though it hasn’t necessarily felt that way with the up and down days so far because the things that have done poorly have been offset by other things around the world that have done a lot better.

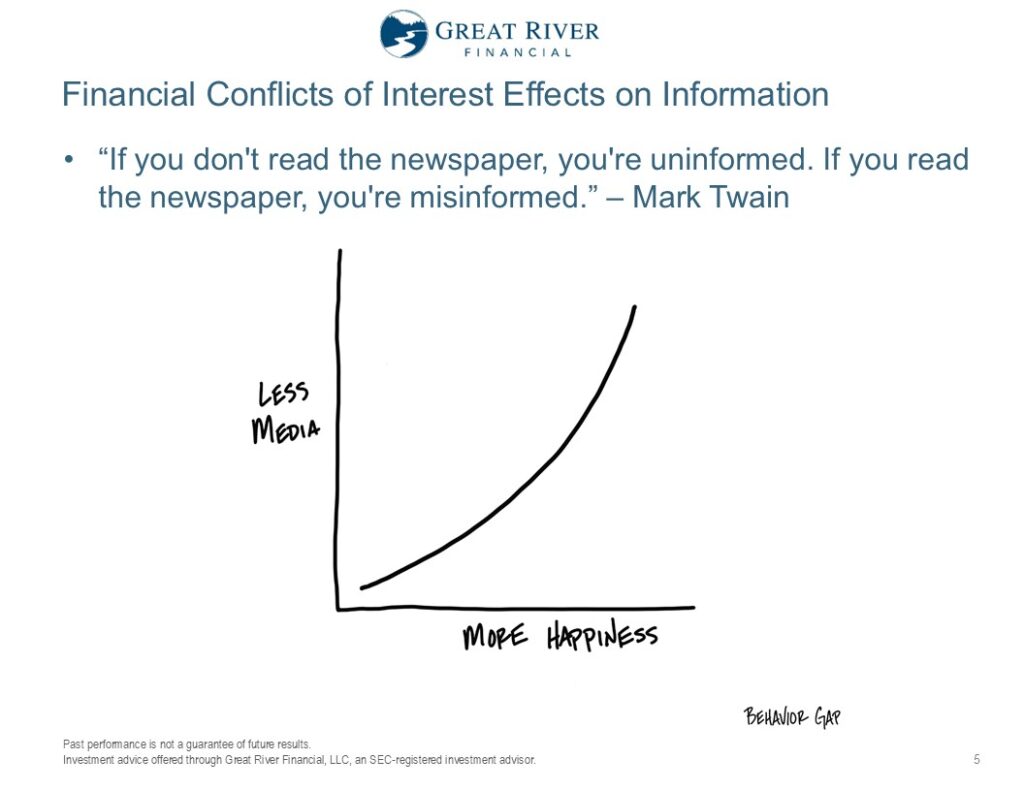

Financial Conflicts of Interest Effects on Information

Many of us feel a disconnect between the numbers on the prior page where a diversified portfolio is relatively flat in 2025 and how this year has, actually, felt. In large part, this is because of how information is framed by the media and largely driven by their business model. They make more money by subscriptions and clicks and attention – not on how well they frame information. So, it’s not accuracy, but it’s attention. That’s how they make more money. This is not a new problem. Mark Twain has been dead for more than a hundred years and it was true in his time. If you look at this quote, “If you don’t read the newspaper, you’re uninformed. If you read the newspaper, you’re misinformed.”. I love this illustration by Carl Richards, who illustrates for the New York Times, is the less media that you consume the more happiness you’re going to have. I’d also contend that you’ll likely have a better investment performance over time because you’re less likely (including me as the adviser) you’re less likely to make short-term decisions rather than adhering to the long-term financial plan.

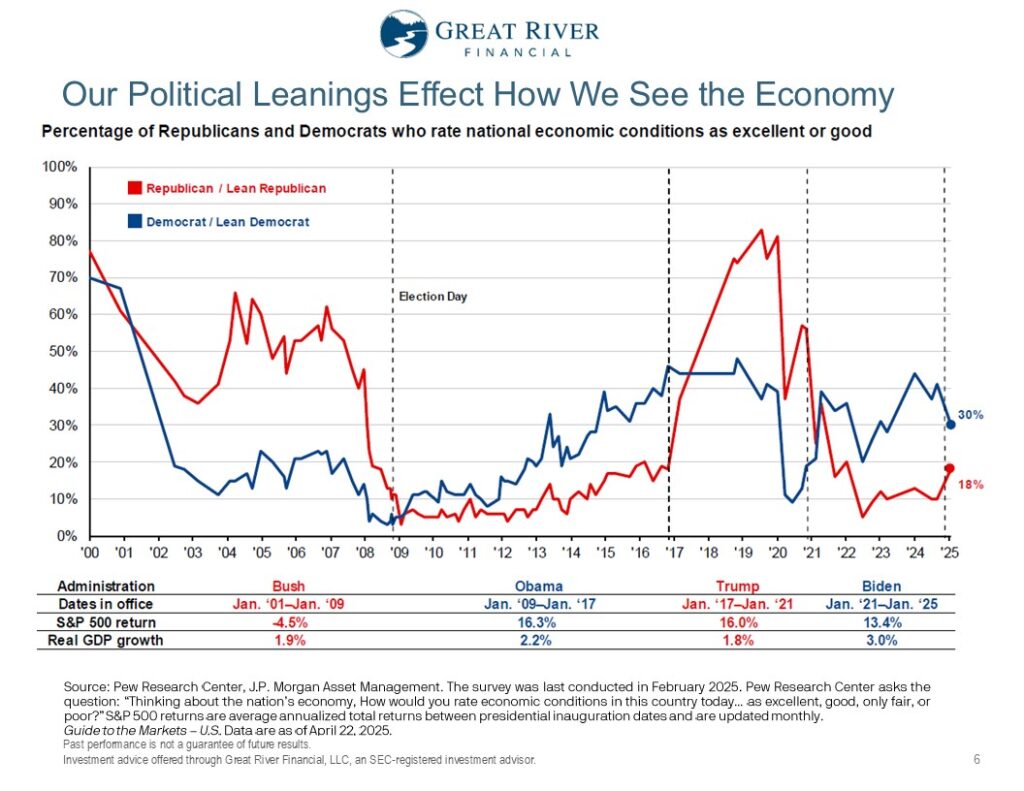

Political Leanings Effect How We See the Economy

It’s important for us to appreciate how our own political leanings affect how we see the economy and the markets. Now for multiple administrations it’s been consistent that when there’s a Republican in the White House Republican voters tend to be more optimistic about economic conditions and vice versa when a Democrat is in power. I would expect if you keep going to the right on this graph that when we get to 26-27 that the blue line will go below the red line. Negative sentiment about the policies being enacted doesn’t necessarily mean we’re going to have bad GDP growth because we’ve had consistent GDP growth between say 2-3% under all sorts of different administrations over the last, not just 25 years, but for multiple decades in the US.

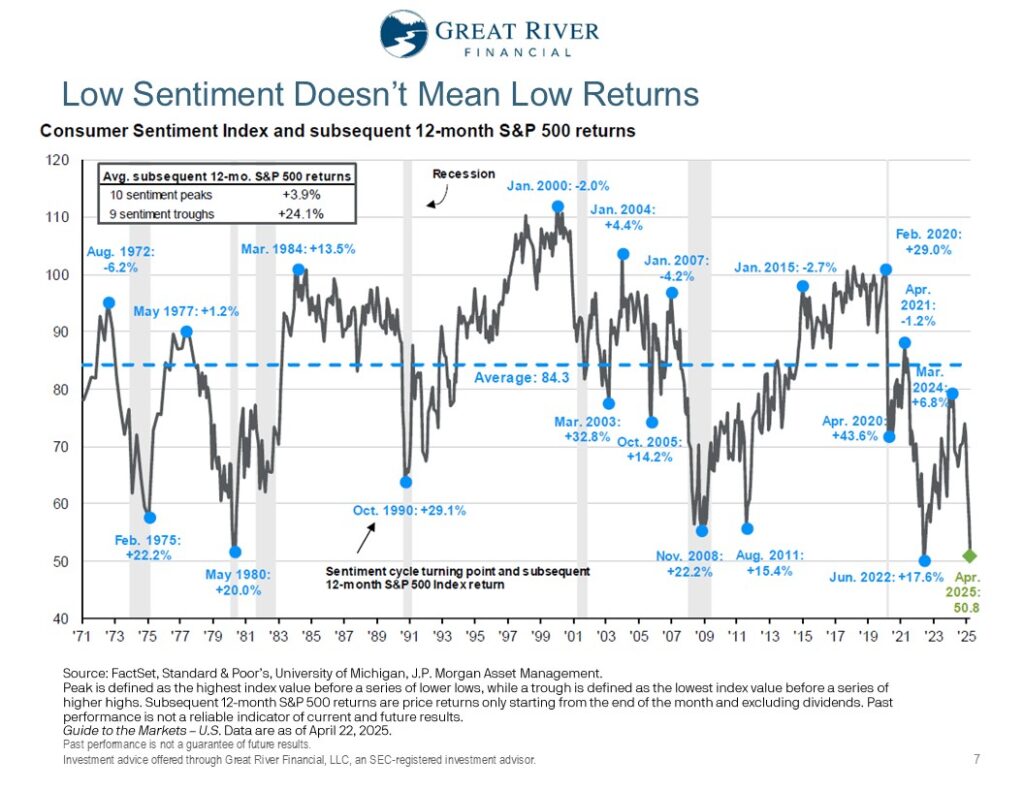

Low Sentiment Doesn’t Mean Low Returns

The current consumer sentiment is relatively low compared to the last 50 years’ worth of averages. That doesn’t necessarily mean we’re going to have below average returns in the stock market over the next 12 months. In fact, historically, when we’ve looked at peaks in sentiment over the last 50 years the next 12 months in S&P 500 average returns is only 3.9%, so positive but below long-term averages. Whereas the best performance in markets has been after these troughs. So, over these nine troughs over the last 50 years in consumer sentiment we’ve had average returns of 24.1%. Now that doesn’t mean we’re going to have 24% on average over the next 12 months. We don’t even know if our current sentiment is as low as it can go. We could have a lower trough, but it is a reason to not change our allocation to stocks based on not feeling good about our current economic environment. Because historically not feeling good about the economic environment has been a better time on average to invest.

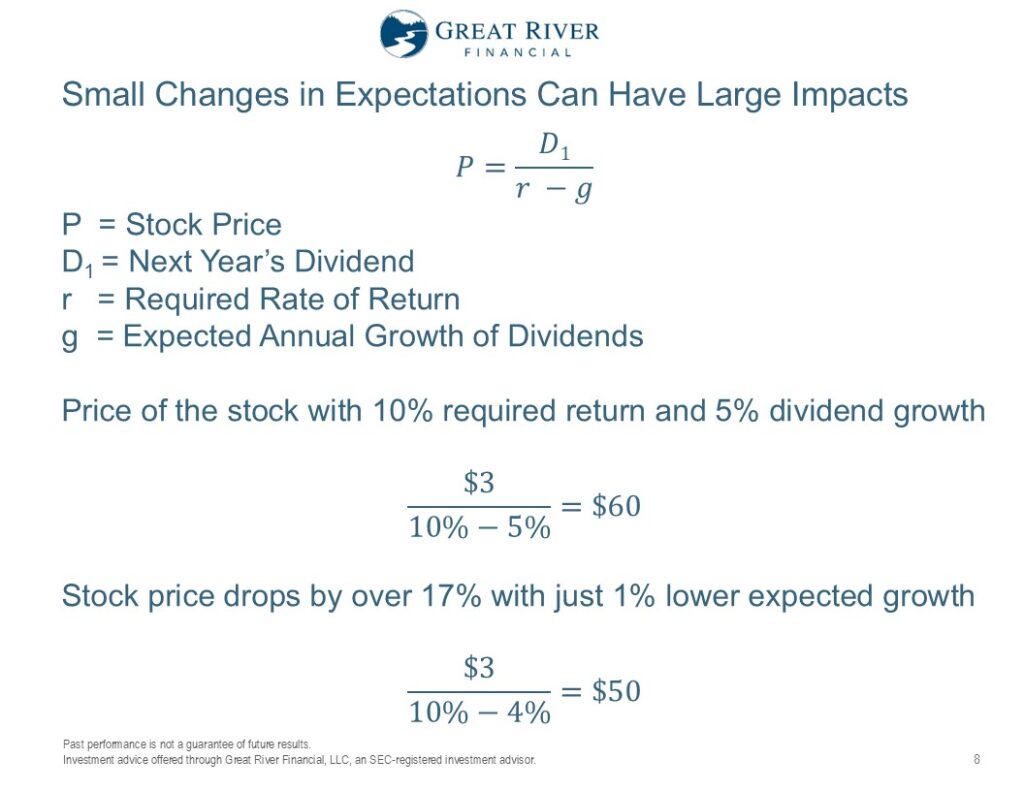

Small Changes Can Have Large Impacts

As many of you know, I teach the Investment Planning course of the Certified Financial Planner designation and in that one of the things I teach is the theory behind how you come up with a fair market price of a stock based on its performance. That performance includes things like dividends or free cash flows, it includes things like the required rate of return, so riskier companies like a small tech startup have higher required rates of return than something like Excel Energy, like a utility. Then what are the growth rate expectations of those dividends, or free cash flows, or profits of the company. For an example, if we had a company paying a $3 per year dividend with a required rate of return of 10% and a dividend growth rate of 5%, expectation that we would expect that stock to be trading right around $60. So, the idea is if it’s trading at $50, we should buy it because it’s undervalued. If it’s trading at $70 we shouldn’t. Or, if we own it maybe we would consider selling it at $70. Now tiny changes in expected growth rate in next year’s dividend in required rate of return can have big differences in prices. For instance, if we assumed everything else being the same except for the expected growth rate on dividends went from 5% to 4%, so just a 1% lower growth rate, it would actually decrease the price all the way to $50 from $60, which is a stock price dip of about 17%. What’s important to understand is when there’s shocks in the market, whether it be right at the beginning of COVID and we thought growth rates on dividends would be much lower, or with tariffs in April of 2025 – little changes in expectations can have big price movements. What’s important to remember is the market in the short term might not be right about those expected growth rates. Right at the beginning in March of 2020 there was an expectation that there would be much lower growth as a result of COVID, but with stimulus and that it didn’t have as much economic impact as originally thought, prices bounced back relatively quickly because the market recalibrated to renewed growth expectations. It’s important to understand when there’s big changes in market prices that doesn’t necessarily mean that this 1% lower expected growth rate in the dividend is necessarily going to happen in the real world. But the market doesn’t like uncertainty and when there’s uncertainty they tend to adjust their expectations and even just a little bit makes prices go down or up, significantly.

Key Takeaways

Some key takeaways, although US Stocks are down in 2025 globally diversified portfolios are relatively flat because investments around the world have done better than US Stocks, so far this year. We should be skeptical about the media’s portrayal of market and economic information because they’re trying to drive attention, not necessarily understanding. Another thing to remember is your financial projections are built with the expectation that there’s going to be multiple times where stocks go down 20 to 30% during the rest of your retirement, so this isn’t anything unusual. We don’t know necessarily when this will happen, or what the catalyst will be, but we should expect that they happen multiple times and we’re not even at the point where we have a bear market – it’s just markets are down a little bit in 2025. And to remember that our investments need to be focused on your financial plan of when you need the money – not when the news cycle is. So, if you’re young market volatility isn’t fun, but you have many years to recover. If you’re in retirement we have a cash buffer, we have a bond buffer before we need to sell any stocks, so markets can be down for years and still be okay because we’ve planned for that. If you have any questions about this or you’d like to talk about anything in more detail, feel free to schedule time with us, give us a call, shoot us an email, we’d love to talk to you. This is Josh Wolberg with Great River Financial – stay curious my friends.